The IRS extended the penalty deadline so that they only begin accruing for returns filed after Septeminstead of the regular due date. Important: the IRS announced in late August of 2022 that late filing penalties for 20 Returns are being abated or refunded if a taxpayer already claimed them.

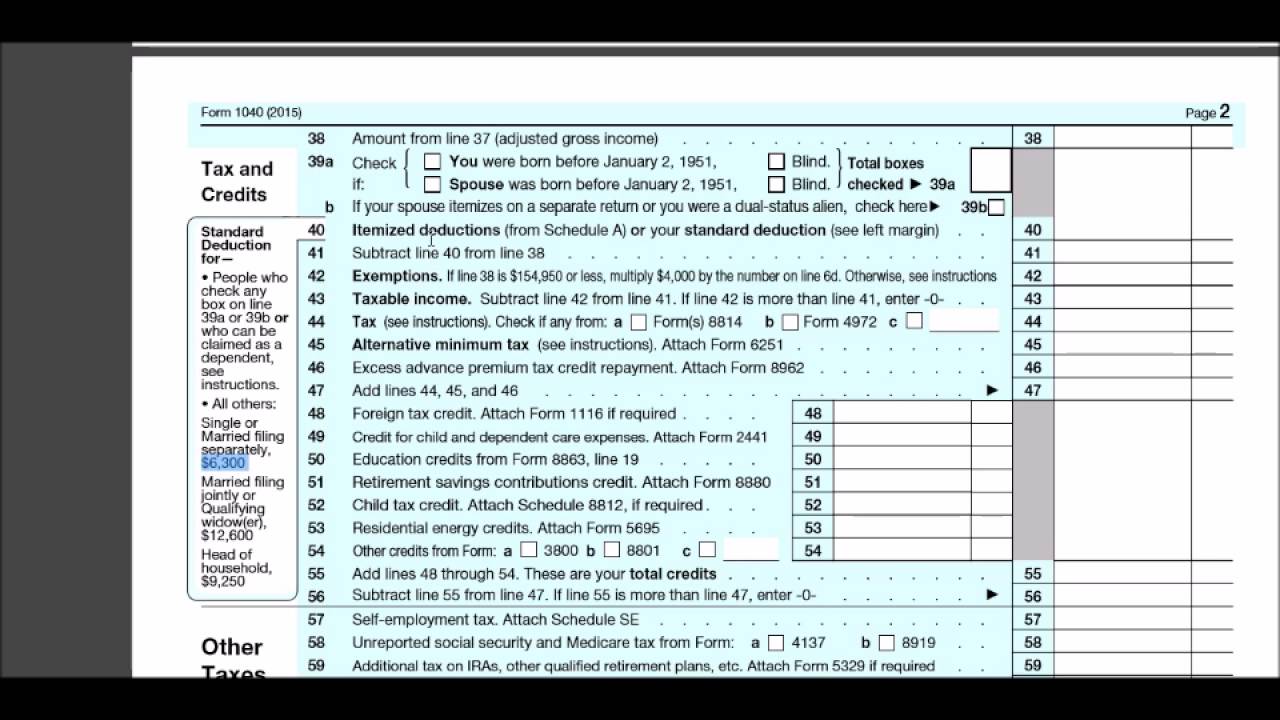

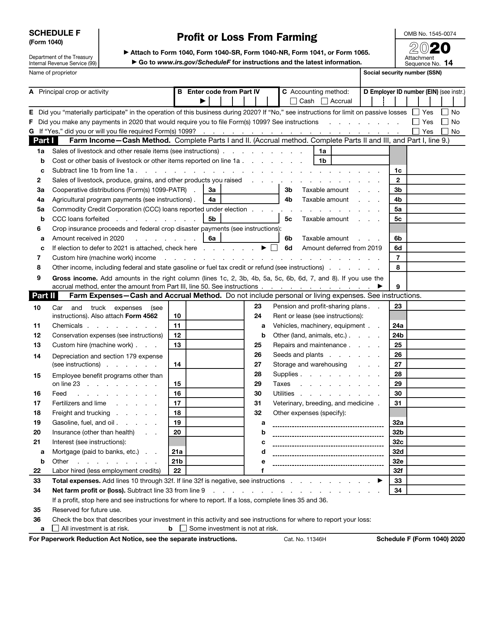

If you owed taxes, late filing penalties may apply to your tax liability. You had until Octoto e-File 2020 Tax Returns, but you can - and should! - still file your 2020 Return this year. IT is Income Taxes: Do IT for less on and eFileIT.Ģ020 Tax Return Forms and Schedules for January 1 - Decemcan be only be paper filed now - FileIT. Compare our tax services and see why you should file electronically each year to get your refund fast. If you started your 2020 Return on but did not file it, see how to file an incomplete return from your eFile account.Į-File your return online each year with a free account so you do not have to worry about handling any complicated tax forms. Tax Tip: e-file something - return or extension - even if you can't pay anything! Why? Less penalties! If you owe taxes, you would not owe late filing penalties, but you could be subject to late payment penalties. If you miss this deadline you have until October 15 following the April 15 date regardless of if you e-filed a tax extension. Prepare and e-file your IRS and state current year tax return(s) by April 15 following a given tax year. See our state tax page for state forms and addresses. Use these free online, fillable forms to complete your 2020 Return before you sign, print, and mail your return to the 2020 IRS address. To file 2020 Taxes for free, start with the 2020 Tax Calculator to estimate your 2020 Return before filling out the 2020 Tax Forms listed below - or, you can search for tax forms. This also applies to 2020 state income tax returns. As of October 15, 2021, IRS income tax forms and schedules for Tax Year 2020 can no longer be e-filed, thus 2020 Taxes can only be mailed in on paper forms.

0 kommentar(er)

0 kommentar(er)